understanding of Uniswap marker pair of gas fees with Metamk

Ethereum blockchain’s decentralized exchange platform UnisWAP allows users to trade assets with minimal slip and costs associated with transaction processing. However, gas fees for different markers can vary considerably, causing significant savings or losses to traders.

Why do swap transactions have a different gas fee?

When you make one active (marker) from one pair to Uniswap to another, your Ethereum safe sends a deal that requires computing power and gas. The gas fee is determined by the complexity of the Ethereum virtual machine (EVM), which includes factors such as the number of input transactions, gas prices and network fees.

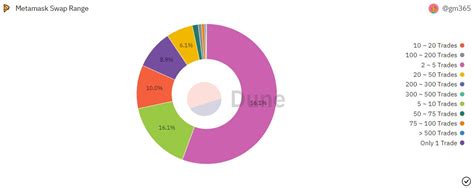

Marker Pair Gas Fee: Distribution

Let’s test two hypothetical scenarios using Metamask:

* USDT to PBX

: The intended gas fee for this swap is $ 700. This indicates that Metamk assesses significant computing efforts to make a transaction.

* USDT to ETH : The intended gas fee for this swaps is only $ 300, which corresponds to Metamk, subject to reduced EVM complexity when calculating the gas fee.

** Why are different markers charged differently?

Several factors contribute to the desired gas fee:

1

EVM complexity : Uniswap Architecture and Ethereum Network play an important role in determining gas fees. Different tokens have a different level of computing requirements that affect the calculated gas fee.

- Token pair characteristics : Gas consumption and costs related to transactions to specific pairs of markers may differ from factors such as the volume of transactions, the excitement of the network and the complexity of the smart contract.

3

The complexity of the transaction : interactions with multiple transactions, such as USDT to ETH (eg ETH buying via USDT) requires greater computing efforts than simple swap transactions that cause higher gas fees.

Conclusion

Different gas fees for different uniswap markers illustrate the complexity associated with the Ethereum blockchain and the decentralized exchange ecosystem. By understanding these differences, merchants can optimize their strategies by reducing possible losses or benefits of swaps related to special asset pairs.

In order to provide accurate gas fees calculations, traders should consider factors such as the complexity of the transactions, the congestion of the network and the performance of the smart contract in assessing the swaps uniswap.