The Rise of Cryptocurrency and Digital Collectibles: Understanding the Intersection of Crypto, Continuation Pattern, NFTs, and ICOs

In recent years, the world of cryptocurrency has experienced rapid growth, with many new players entering the market. This influx of new entrants has led to a surge in interest among investors, entrepreneurs, and enthusiasts alike. One of the most significant developments in this space is the rise of digital collectibles, which have become increasingly popular as a form of investment and entertainment. Two key concepts that are driving this growth are Continuation Patterns and Initial Coin Offerings (ICOs).

What are Continuation Patterns?

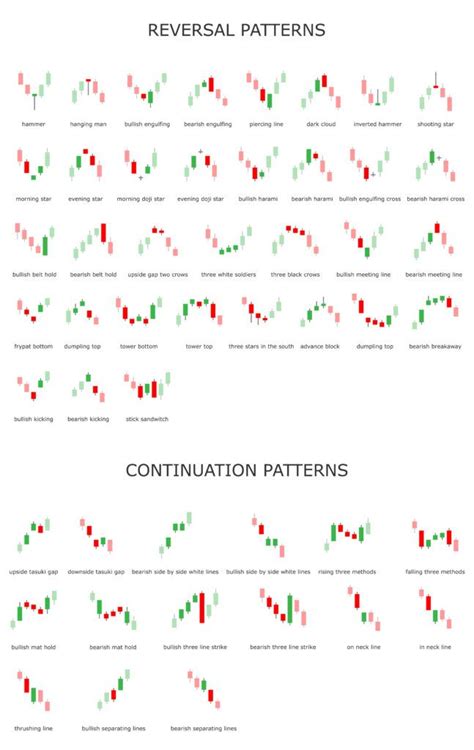

Continuation patterns are a mathematical concept used to analyze the behavior of asset prices over time. They identify patterns in price movements, allowing investors to make more informed decisions about where to allocate their capital. In the context of cryptocurrency, continuation patterns can help traders and investors identify trends, predict price fluctuations, and adjust their strategies accordingly.

The Importance of Continuation Patterns in Cryptocurrency

In the world of cryptocurrency, Continuation patterns play a crucial role in identifying trends and predicting price movements. By analyzing historical data and market dynamics, investors and traders can develop a deeper understanding of the underlying mechanics that drive asset prices. For example, some notable continuation pattern-based strategies include:

- Moving Average Crossovers: This strategy involves buying an asset when its short-term moving average crosses above or below its long-term moving average.

- Relative Strength Index (RSI) Indicators: These indicators measure the magnitude of price changes in relation to volatility. A strong RSI can indicate that a trend is nearing its end, while a weak RSI may suggest that an asset is due for a bounce.

What are Initial Coin Offerings (ICOs)?

Initial Coin Offerings (ICOs) are a type of fundraising event where new cryptocurrencies or tokens are launched into the market. ICOs allow project developers to raise funds from investors by offering tokens in exchange for a set period of time, usually several months. The primary goal of an ICO is to generate excitement and attract early adopters while also providing a way for investors to buy and own a piece of the new token.

The Rise of NFTs (Non-Fungible Tokens)

NFTs are digital assets that are unique and scarce, unlike traditional cryptocurrencies or tokens. They can represent everything from art and collectibles to in-game items and even real-world assets like property. The rise of NFTs has been driven by the increasing demand for unique digital content and the growing recognition of blockchain technology as a viable solution for various industries.

How are ICOs Linked to Continuation Patterns and NFTs?

ICOs can be seen as a form of continuation pattern-based strategy, where investors buy into new cryptocurrencies or tokens that have been launched through an ICO. These new assets can then continue to trend upward, driven by their respective Continuation patterns. In the context of NFTs, for example:

- NFT market volatility: The price of NFTs can be influenced by their rarity and scarcity, as well as the demand for specific items.

- Continuation patterns in NFT pricing: Investors can identify continuations patterns in NFT prices by analyzing historical data and market dynamics.

Conclusion

The intersection of cryptocurrency, Continuation Pattern, NFTs, and ICOs represents a rapidly evolving landscape. As investors, entrepreneurs, and enthusiasts continue to adapt to the changing market, it is essential to stay informed about these concepts and their applications in the space.