Here’s an article about cryptocurrencies, FOMO, Stop Loss, and Uniswap (UNI) with the word “FOMO” in the title:

“Don’t Get Caught Off Guard: A Beginner’s Guide to Cryptocurrencies, FOMO, Stop Loss, and Uniswap (UNI)”

For many investors, the world of cryptocurrencies can seem overwhelming, especially when it comes to navigating the emotional rollercoaster known as fear of market optimism (FOMO). While some may view cryptocurrencies as a high-risk, high-reward investment opportunity, others are more cautious and prefer to play it safe.

Fear of Missing Out (FOMO): One of the biggest fears for many investors is missing out on potential gains. FOMO can be particularly debilitating when it comes to cryptocurrency investing, especially for those who have invested a lot of money in the space. The constant news cycle of market volatility and regulatory changes can create an atmosphere of anxiety, making it difficult for investors to make informed decisions.

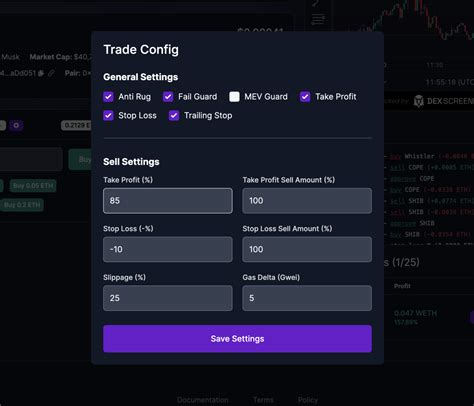

Stop Loss

: A stop loss is a key tool for anyone looking to limit potential losses when investing in cryptocurrencies. It’s essentially a set price at which you’ll sell your assets if the market moves against you. By setting a stop loss, you can avoid significant losses and protect your investment from catastrophic declines.

Uniswap (UNI): Uniswap is one of the most popular decentralized exchanges (DEXs) in the cryptocurrency space. Launched in 2018, Uniswap has established itself as a platform for trading liquidity protocols, including UNI. As with any cryptocurrency investment, you should do thorough research and understand the risks involved with Uniswap before investing.

A Beginner’s Guide to Cryptocurrency, FOMO, Stop Loss, and Uniswap (UNI)

If you’re new to cryptocurrency investing or are just looking to get back into the market after a long break, this beginner’s guide aims to provide an overview of several key concepts and tools. Here are a few takeaways:

- Risk Management: When it comes to FOMO, prioritizing risk management is key. This means setting a stop loss, diversifying your portfolio, and understanding the risks of different investment options.

- Education

: Continuing education about cryptocurrency investing is key to making informed decisions. There are many resources available online, from blogs and podcasts to books and courses.

- Diversification: Spreading your investments across multiple asset classes can help reduce risk and increase potential gains. Consider diversifying into other cryptocurrencies or asset classes, such as stablecoins or fiat currencies.

By following these guidelines and keeping FOMO in mind, you can make more informed investment decisions and avoid costly mistakes. Remember to always do your research, stay disciplined, and never invest more than you can afford to lose.

I hope this article has been helpful to you!