The Interplay of AI and Tokenomics in the Crypto Ecosystem

As the cryptocurrency market continues to evolve, artificial intelligence (AI) is increasingly being used to revolutionize various aspects of the ecosystem. One area where AI and tokenomics overlap is the development of decentralized autonomous organizations (DAOs), initial coin offerings (ICOs), and other token-based projects.

What is tokenomics?

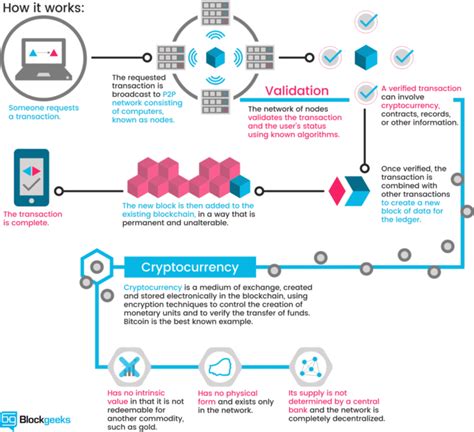

Tokenomics refers to the study of the economics, design, and implementation of tokens, the digital assets used to facilitate various transactions within a blockchain network. The term was coined in 2014 by Vitalik Buterin, one of the co-founders of Ethereum. Tokenomics involves analyzing the properties of each token, such as supply, scarcity, and usage rights, to create a more efficient and scalable ecosystem.

The Role of AI in Tokenomics

Artificial intelligence is increasingly being used to optimize tokenomics on various blockchain platforms. AI algorithms can analyze massive amounts of data, including transaction logs, market trends, and community sentiment, to identify patterns and predict future outcomes. This allows developers to create more effective token models, improve liquidity, and reduce the risk of market volatility.

Some examples of how AI is used in tokenomics include:

- Predictive Modeling: AI can be trained using historical data to predict token price movements, helping investors make more informed decisions.

- Scalability Optimization: AI can analyze network congestion patterns and identify bottlenecks, allowing developers to optimize their token models for better scalability.

- Token quality assessment: AI-powered tools can assess the quality of tokens based on metrics such as security, decentralization, and community engagement.

The interplay between AI and tokenomics in DAOs

DAOs (Decentralized Autonomous Organizations) are a type of blockchain-based organization that operates autonomously without a central authority. Like tokenomics, AI is used to optimize how DAOs function across different platforms.

One example of this is the use of AI-powered token distribution systems. These systems can analyze token supply and usage patterns to ensure optimal token allocation and minimize the risk of token dilution or waste.

Benefits of combining AI and tokenomics

Combining AI and tokenomics offers several benefits, including:

- Improved efficiency: AI can automate complex tasks such as token validation and distribution, allowing developers to focus on more strategic aspects.

- Improved security: AI-powered tools can detect potential security threats and anomalies in the blockchain network, reducing the risk of hacking or tampering.

- Increased transparency: AI-driven analytics can provide a deeper understanding of token usage patterns, market trends, and community sentiment.

Challenges and future directions

While the intersection of AI and tokenomics is promising, there are also challenges that need to be addressed. These include:

- Data quality: The accuracy and reliability of data analysis depend on high-quality datasets and robust data validation processes.

- Regulatory compliance: As the use of AI in tokenomics becomes more widespread, regulators must adapt to address new concerns about token management and security.

- Scalability

: Developing AI-powered systems that can handle large-scale transactions and complex networks is a significant challenge.

Conclusion

The interplay between AI and tokenomics has the potential to revolutionize various aspects of the cryptocurrency ecosystem. If developers continue to harness the power of artificial intelligence, they will be able to create more efficient, scalable, and secure blockchain-based systems.